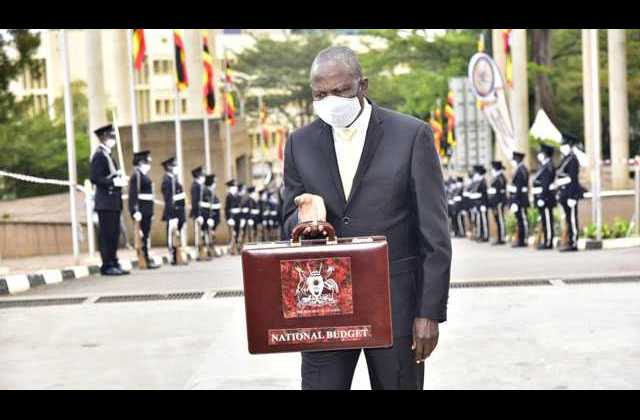

The Finance Minister Hon. Matia Kasaija has Thursday presented the Budget speech for the 2020/21 under the theme: “Stimulating the Economy to safeguard Livelihoods, Jobs, Businesses and Industrial Recovery”.

The UGX 45.4 trillion Revenue and Expenditure estimates for the Financial Year 2020/21 were approved by Parliament on 24th April 2020.

While reading the budget, Hon. Kasaija revealed that the economy has continued to grow, despite the effects of the recent emergencies the country has faced. Uganda’s GDP in the year 2019/20 is estimated to amount to U. Shs. 138 Trillion.

The economy is also estimated to grow by 3.1 percent this financial year ending 30th June 2020, slower than the average growth rate of 5.4 percent in the previous four years. He added that had it not been the emergencies Uganda has faced in the last six months, the rate of economic growth would have been at least 6 percent per annum.

The Agriculture sector grew by 4.2 percent up from 3.8 percent in the previous four years. Coffee production increased from 5.7 million 60-kg bags to 7 million bags between 2017 and 2019. Fish catches have grown from 391,000 Metric Tons to 561,000 Metric Tons between 2017 and 2019.

Despite all this, agriculture sector has been allocated UGX 1.3 trillion, up from UGX 1trillion last financial year. The president has identified 14 products that will be developed commercially this financial year, to improve food security. These products are maize, cassava, banana, beans, Irish potato, sweet potato, millet, sugar cane, cattle (beef), dairy, coffee, tea, cocoa and fish.

“To reduce post-harvest losses, the construction of storage facilities of 42,000 Metric Tonnes capacity that commenced in Iganga, Isingiro, Amuru, Kalungu, and Nebbi will continue” the minister said.

The health sector has been allocated UGX 2.7 trillion that will be used to promote health for all Ugandans, and to ensure the recruitment of additional health workers and also provide for their welfare.

The Education sector has been allocated at UGX 3.5 trillion. According to Kasaija, government will roll out the new education curriculum, including Early Childhood Development (ECD) curriculum, expand access to Vocational Education and Training, including international accreditation of Business, Technical, and Vocational Education and Training (BTVET) institutions as Centres of Excellence, Improve the quality of tertiary education institutions by ensuring their adequate staffing and increasing the emphasis on academic research, Enhance teaching supervision using digital platforms in the inspection of schools through scaling up the Integrated Inspection System; and Develop the provision of lessons through digital platforms such as TV, Radios and the Internet to ensure continuous learning and implement the electronic delivery mode in validation and distribution of self-learning materials to learners.

Meanwhile, the works and transport sector takes the lion’s share with UGX 5.88 trillion, followed by security with UGX 4.52 trillion, Energy and Mineral Development UGX 2.6 trillion.

Kasaija says that Government expects to get money to finance the budget from taxes by collecting UGX 21.7trillion, while the rest will be through domestic and external borrowings, aids and grants.

Some of the affected products are; beer produced from barley grown and malted locally, that will see an excise duty of UGX 1,115 per litre and UGX 2,050 per litre on malt beer. Also, an excise duty of UGX 1,700 per litre has been slapped on ready to drink spirits, UGX 1, 350 per litre on gasoline, UGX 300 per litre on kerosene, and UGX 1, 030 per liter on gas and oil.

Wines made from locally produced raw materials are also set to suffer an excise duty of UGX 2,300 per litre, UGX 1,500 per litre on undenatured/wood spirits made from locally produced raw materials. There is also excise duty of UGX 250 per litre on non-alcoholic beverages (Soda) not including fruit or vegetable juice and excise duty of Shs 100,000 on licenses for provision of professional services.

In his speech, President Museveni re-echoed his disappointment in corrupt government officials, specifically pointing at Uganda Revenue Authority where senior commissioners have been fired.

“Whoever is corrupt, we shall get you. We shall clean you like we did the URA crowd” he warned.

A new presidential initiative on wealth and job creation (Emyooga) has been officially introduced. Emyooga is a new initiative centred on various enterprises/categories and is part of a broad government initiative of social economic transformation.

The intervention targets to transform 68% of homesteads from subsistence to market oriented production through promoting job creation and improving household incomes and it targets 17 enterprises of Boda Bodas, women Entrepreneurs, Carpenters, Salon operators, Taxi operators, Restaurant owners, Welders, Market vendors, Youth leaders, PWDs, Produce dealers, Mechanics, Tailors, Journalists, Performing Artists, Veterans and fishermen.

Comments (0)

📌 By commenting, you agree to follow these rules. Let’s keep HowweBiz a safe and vibrant place for music lovers!